Files: BW_RT103.xml / BW_ReconciliationReport.xlsx / UI_BW_RT103_IFRS.xml

This report includes 4 sheets for checking from different angles how the input internal transactions reconcile, and whether they require adjusting.

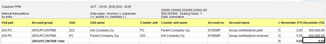

•The first sheet shows totals by unit pairs for selected and previous period. To view units' input rows click plus sign on the left from unit pair total row.

•The report opens on the second sheet by default, where totals are shown by account group. It is possible to reconcile account group totals to reconciliation accounts' consolidated data. Opening the row grouping shows difference within the account group by unit pair, leaving the input row level as the next level. Data columns in this sheet include input data in selected currency and in input currency.

•The third sheet shows by default the same unit pair totals as the first sheet, but opening the row grouping shows also account group totals by unit pair. Opening the next level show input level data rows.

•The last sheet shows the internal transactions by unit pairs and by account groups, all periods of the active year

By default, all entries are included where unit and counter unit are within the selected (consolidated level) unit. The report includes internal transactions from the input account level from document series 20 000, 23 000, 120 000, 123 000, 320 000, and 323 000. The data is cumulative.

The internal transactions by unit pairs are shown by account groups (for more information about account groups, see Clausion Financial Performance Management Administrator's Guide). Also external accounts are shown on the report according to the account groups they are connected to.

When the opening balance transfer is done for the active year, the closing balance from period 12 of the previous year is shown as the opening balance for period 0 for the active year also for document series 20 000, 120 000, and 320 000 (if document series 420 000 is used, a new customer-specific task needs to be added for it).

The same signs are used as in accounting. Note that intragroup notes accounts (e.g. loan changes) are shown only on the last sheet of the reconciliation report.

If the internal transactions of a unit need to be adjusted due to reconciliation, the adjustments must be done to the intragroup document series 20 000, 120 000, or 320 000 in the unit's income statement and balance sheet. Also it is possible to leave the difference on reconciliation account, and also change place of the reconciliation difference in Financial statements by Other eliminations task using "Transfer of reconciliation" accounts.

Note! Account 231 000P Profit/loss for the period is not shown on the report, because the input type calculated is not retrieved.