Files: P_REPORT_109.xml / P_REPORT_109.xlsx / UI_P_REPORT_109.xml

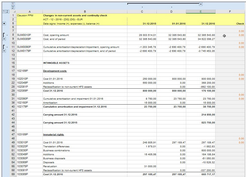

The report presents changes in the balance sheet items of non-current assets. At the top of the report, before the balance sheet item review, there is a summary of the acquisition cost of the balance sheet items and the accumulated depreciation . The information in the report is cumulative and presented in the Group's currency.

The first data column (C) shows the amounts for the end of the previous year, the second data column (D) shows the opening amounts for the selected year and in the third data column (E) presents the amounts for the selected period.

The fourth data column has two control formulas for continuity analysis:

•The first formula compares the ending balance of the previous financial year (1st data column: period 12 / %YEAR CODE -1%) and the opening amount of the selected year (2nd data column: period 0 / %YEAR CODE%).

•The second formula compares the opening amount of the selected year (2nd data column: period 0 / %YEAR CODE%) and the opening amount of the selected period (3rd data column: %PERIOD CODE% / % YEAR CODE%).

By default, columns show the document series of the FINSTMT_IFRS parameter. In the first data column of IFRS report also document series of comparative adjustments (FINSTMT_COMPIFRS) are included. The default value for document series is defined in the task's user interface definition and can be changed on the Advanced tab.