Files: P_REPORT_21.xml / P_REPORT_21.xlsx / UI_P_REPORT_21.xml

This report is used for checking the saved entries and to verify that the reversals of tax based reserves have been recorded according to latest actuals.

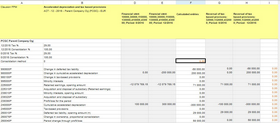

The report shows the data made by input unit, calculated reversal entries and compares them to the elimination entries.The report generates all input units under the selected consolidation level. The data is reported in the unit currency, and the type of data is cumulative.

The first column (D) shows the opening amounts from the period 0, the second column (E) amounts from the the end of the period, and the third (F) calculated entries based on input unit's financial statements. The column G and H shows the saved data from the elimination inputs. The check column (I) compares columns F and H and shows the possible differences between calculated entries and eliminations.

When there is a difference between calculated entries and eliminations, check if changes have been made to units after saving eliminations. Then, save the elimination sheet again in order to correct the entries.

The following table describes the calculation of entries (column F):

Row |

Calculation |

|---|---|

990600P Change in deferred tax liability |

Tax % * change in P/L (cumulative accelerated depreciation and provisions) + change in the opening amount of deferred tax liability due to change in tax percent. |

980000P Chance in cumulative accelerated depreciation |

Change of cumulative accelerated depreciation recognised in document series 10 000, 30 000, 110 000, 130 000, 410 000, 430 000 |

980100P Change in tax-based provisions |

Change of tax-based provisions recognised in document series 10 000, 30 000, 110 000, 130 000, 410 000, 430 000 |

995000P Minority interests in net income |

Minority interests based on change in P/L. Minority interests is calculated when 'Full consolidation' is defined as consolidation method of the unit. |

225000P Retained earnings, opening amount |

Previous year's share of cumulative accelerated depreciation and provisions, tax and consolidation percents are retrieved from period 0 (like in the end of previous year) |

225310P Acquisition and disposal of subsidiary (Retained earnings) |

Change due to change in ownership. In the elimination of equity investment the sum must be added to the equity at the time of acquisition. |

239010P Minority interests, opening amount |

The opening amount of Minority interests is calculated from the amount of cumulative accelerated depreciation and tax-based provisions accumulated before reporting year; tax and consolidation percents are retrieved from period 0. |

239320P Acquisition and disposal of subsidiary |

The balance of account 225310P with the opposite sign. |

239390P Minority interests in net income |

The balance of account 995000P with the opposite sign. |

240000P Cumulative accelerated depreciation |

Cumulative accelerated depreciation recognised in document series 10 000, 30 000, 110 000, 130 000,410 000, 430 000 with the opposite sign. |

245000P Tax-based provisions |

Tax-based provisions recognised in document series 10 000, 30 000, 110 000, 130 000, 410 000, 430 000 with the opposite sign. |

260010P Deferred tax liability, opening amount |

Deferred tax liability of cumulative accelerated depreciation and tax-based provisions accumulated before reporting year; tax and consolidation percents are retrieved from period 0. |

260076P Deferred tax liability, Change in ownership, proportional consolidation |

Change in deferred tax liability due to change in ownership in proportional consolidation. |

260040P Deferred tax liability, period change through profit/loss |

The balance of account 990600P with the opposite sign. |