Calculated accounts are used for a value generated from another account (source account) when the calculated account cannot be defined as a sum account for the source account(s).

The calculation is done in unit currency amounts, and the value is converted according to the properties of the calculated account. This means that in group currency the value may differ from the value of the source account.

If the Reverse Entry option has been selected in the calculated account definitions, a credit entry is created when the entered amount is a debit entry, and vice versa.

If the source account is a sum level account, the calculation is performed for all its input accounts, and the resulting sums are added together to make up the value entered to the calculated account.

If an Input type column has been added to a template as a definition column, all entries (manual, auto, and calculated) are shown in the template. If an input type column of type "calculated" has been added to a template as a data column (Calculated), the column displays the calculated entries.

Comment of the following format is displayed for automatic calculated entries when drilling down to view the entries: ACA_Rule_ID: Source_Account_ID -> Target_Account_ID. For example, ACA00001: 231000 -> 210200

Entries created for the eliminations of equity investments are also subject to automatic calculations for calculated accounts.

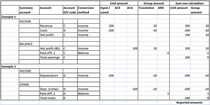

The following is an example of input data, related automatic calculations and returned report values. The calculations are shown in the order (from left to right) in which they are executed when data is saved from an input template. The following settings apply for all data: •show dk profit = inverted sign •show dk balance = no •show dk other = no •Input in SEK •Rates: income statement 10, balance sheet 9 The following table shows the automatic calculated account (ACA) and automatic rate difference (ARD) definitions for the accounts. There are no automatic counter entry (ACE) definitions related to the accounts. Table 19: Relevant definitions for the accounts

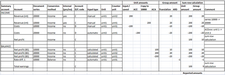

Input and reporting to 10 000 document series (applies also to all document series except for series of type 2 and 23): Figure 7: Input and reporting of document series other than type 2 or 23 Input to 20 000 document series: Additional settings and definitions: •There is a valid connection between document series 20 000 and 10 000. •There is a valid ACE definition for the data type for series 20 000. Account: Revenue (int), counter account: Costs •Both units are SEK units. Figure 8: Input and reporting of document series of type 2 (similar applies to type 23) |